Feds reject proposals by Alaska and Wisconsin

The Patient Protection and Affordable Care Act required that the U.S. Department of Health and Human Services ("HHS") establish a process for reviewing unreasonable increases in health insurance premiums in the individual and small group markets. The Rate Increase Disclosure and Review Final Rule[1] established a 10 percent national review threshold for proposed premium increases to individual and small group insurance products for the first year of the federal rate review program, September 1, 2011, through August 31, 2012. For subsequent years, the regulations require that the Centers for Medicare & Medicaid Services ("CMS") establish state-specific thresholds; however, if no state-specific threshold is established, the 10 percent national threshold will remain in effect. The Secretary of HHS must issue a notice by June 1 of each year announcing the state-specific thresholds that will apply in the following year's rate review program (e.g., starting September 1, 2012, for the second year).[2]

The Center for Consumer Information and Insurance Oversight ("CCIIO") in CMS issued guidance outlining the process for states wishing to propose a state-specific threshold.[3] This process recommended that state-specific threshold requests include both analytically-oriented data and policy-oriented data.[4] Analytically-oriented factors should be objectively measurable, have predictive validity, and not be subject to gaming.[5] Policy-oriented factors should be related to administrative burden and administrative capacity.[6] CCIIO also noted that medical costs have not risen any faster since the initial 10 percent threshold was implemented, which "would appear to argue against any increase in the threshold for reviewing rate increases."[7]

This spring marked states' first opportunity to submit state-specific threshold proposals for the federal rate review program. Only two states, Alaska and Wisconsin, submitted requests to CCIIO. CCIIO denied both of the requests on June 1, 2012.

Alaska proposed a 17 percent rate threshold for September 2012 through August 2013.[8] Alaska's justification was based on historical rate increases in the individual and small group markets. The state's request noted that a 10 percent threshold would have historically captured 25 of 30 rate increases in the state. Because of these higher rate increases, Alaska expressed concern that the national threshold "will result in unreasonable expectations by Alaskans regarding what constitutes an unreasonable rate increase."[9] Alaska also argued that the administrative burden of reviewing substantially all the state's rate filings was too great.[10] In its denial, CCIIO relied on national and state cost trend data and noted that these rates, along with Alaska's annual health care cost rate increase of 8.9 percent, were under 10 percent, and, therefore, the national threshold "effectively maintains the standard for balancing benefits and burdens as set forth in the final rule."[11]

Wisconsin did not request a specific threshold but rather asked for the authority to set its own state-specific threshold based on "company-specific medical trend data and historical rate changes."[12] One public comment letter was also submitted to CCIIO requesting that the agency reject Wisconsin's request based on a lack of analytically-oriented factors and public transparency. [13] CCIIO rejected Wisconsin's request and noted that the guidance required the state to submit an actual proposed rate for evaluation.[14]

In summary, it seems that CCIIO is reluctant to grant states broad authority to establish their own threshold methodology and will continue to evaluate only specific threshold proposals. Additionally, CCIIO was not persuaded by insurance market cost dynamics in its review of the submitted threshold proposals. Finally, 48 of 50 states did not even submit a request for a state-specific threshold. Given this initial-year experience, greater state diversity in rate review thresholds seems unlikely in future years.

For more information about this issue of IMPLEMENTING HEALTH AND INSURANCE REFORM, please contact the author below or the member of the firm who normally handles your legal matters.

Serra J. Schlanger

Associate

Epstein Becker Green

Washington, DC

202/861-1859

sschlanger@ebglaw.com

Resources

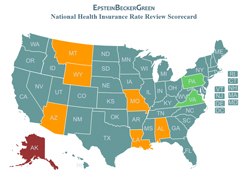

The Epstein Becker Green interactive National Health Insurance Rate Review Scorecard provides more information and an easy-to-use, up-to-date, and comprehensive overview of the applicable rate thresholds, agencies responsible for rate review, and standards for determining an "unreasonable" rate increase for each state and U.S. territory. For a complete summary of the CMS regulations and the rate review requirements and process, see Epstein Becker Green's Implementing Health and Insurance Reform alert "HHS Publishes Health Insurance Premium Rate Review Final Rule, Amends Rule to Include Policies Sold Through Associations, and Lists States with Effective Rate Review Programs" (Sept. 14, 2011).

ENDNOTES:

[1] 76 Fed. Reg. 29,964 (May 23, 2011) (codified at 45 C.F.R. §154.101—154.301).

[2] Id.

[3] Center for Consumer Information and Insurance Oversight, State-Specific Threshold Proposals Guidance for States, March 27, 2012, available at http://cciio.cms.gov/resources/files/rrjssptguidance.pdf.

[4] Id. at 2.

[5] Id.

[6] Id. at 3.

[7] Id. at 2.

[8] Alaska's State-Specific Threshold Proposal, April 30, 2012, available at http://cciio.cms.gov/resources/files/rrj-Sst-proposal-ak.pdf.

[9] Id.

[10] As of June 1, 2012, www.healthcare.gov lists 43 Alaska products not meeting the 10 percent threshold for the first year of rate review. These 43 products fell under five different rate reviews: one individual market rate review and four small group market rate reviews. All five reviews were completed by the state and found "not unreasonable."

[11] Cost trend data included the national Consumer Price Index, National Health Expenditure Data, and Standard and Poor's Healthcare Economic and Commercial Index. Letter from Gary M. Cohen, Director, Oversight Group, Center for Consumer Information and Insurance Oversight, to Linda S. Hall, Director, Alaska Division of Insurance (June 1, 2012), available at http://cciio.cms.gov/resources/files/ak-sst-6-1-12.pdf.

[12] The Wisconsin proposal seemed to indicate that the state-specific rate may be either higher or lower than the national rate threshold, depending on what information was collected from insurance carriers. Letter from Theodore K. Nickel, Commissioner, State of Wisconsin Office of the Commissioner of Insurance, to Sally McCarty, Director of Rate Review, Center for Consumer Information and Insurance Oversight (May 7, 2012), available at http://cciio.cms.gov/resources/files/wi-sst-signed.pdf. As of June 1, 2012, www.healthcare.gov lists 51 Wisconsin products not meeting the 10 percent threshold for the first year of rate review. These 51 products fell under 24 different rate reviews: 11 individual market rate reviews and 13 small group market rate reviews. Two of the rate proposals were withdrawn, 16 are still pending review, and of the six completed reviews, two were found "unreasonable" and four were found "not-unreasonable."

[13] Letter from Robert A. Peterson, Jr., ABC Health, Inc., to Secretary Kathleen Sebelius (May 25, 2012), available at http://cciio.cms.gov/resources/files/abc-for-health-sst-cmts.pdf.

[14] Letter from Gary M. Cohen, Director, Oversight Group, Center for Consumer Information and Insurance Oversight, to Theodore K. Nickel, Commissioner, State of Wisconsin Office of the Commissioner of Insurance (June 1, 2012), available at http://cciio.cms.gov/resources/files/wi-sst-6-1-12.pdf.